I get a lot of calls from solopreneur service providers (think lawyers, accountants, consultants) who are struggling in their businesses. They’re working almost around the clock, fighting fatigue and burnout, and despite all that effort, making less money than they feel they should. They’re frustrated. They took the leap into entrepreneurship because they wanted more freedom to set their schedule, more earning potential, and the ability to be the boss rather than have a boss. It all sounded great at the beginning! But somewhere along the line, something seems to have gone wrong.

So what’s going on? And what can you do about it if you’re a solopreneur in a similar situation?

Gross margin for solopreneurs

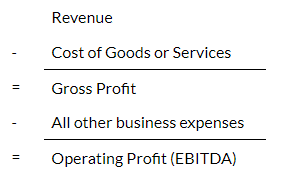

To explain the problem, you’ll need to have some basic knowledge of how a P&L (or Income Statement) works. The P&L is the primary financial statement that shows your business’ performance on a monthly basis. It will show if your business is profitable or not. P&Ls can have a lot of detail, but at the most basic level, they’re just this:

For the purposes of this article, don’t worry about anything below operating profit, as EBITDA is generally the most relevant number when thinking about your business’ profitability. Net income is frequently less relevant because it’s skewed by accounting items like depreciation which are important for tax but make it less obvious how your business is actually performing.

It’s critical for any small business to understand its gross margin, though, because this the largest factor in whether or not the business will be profitable at any scale. To make gross margin easy to understand, let’s start with a simple example of a product business.

Suppose you’re in the business of re-selling widgets. If you buy a widget for $10 and sell the widget for $20, your gross profit, per unit, is ($20 – $10 = $10). You can also represent this as a gross margin ($10 profit / $20 revenue = 50% gross margin).

The zero gross margin solopreneur

Simple, right? Now let’s apply this same concept to a service business. Instead of widgets, you’re selling a service, by the hour, for $50. What does this cost you? This is where a lot of solopreneurs make a key mistake. If they’re the one doing the service work, they think, “It’s me, and I don’t cost anything, so my cost of service is zero.” Therefore, $50 – $0 = $50 of gross profit! And a 100% gross margin, to boot! And… that would be awesome. If it were true.

However, to calculate the true gross margin of a service business, you must factor in the market-rate labor cost. What would you be earning hourly for your service if you were working for someone else? Or drawing a salary? Or paying someone else to do the work, instead? This is where the problem comes in. If you’re selling your service for an average market-rate at $50/hour, and you’d be earning $50/hour working for someone else, what’s your real gross profit per hour?

$50 – $50 = $0 gross profit

This is the same calculation you’d make if you were hiring someone to work for you and perform the service. If you paid them $50/hour then you’d end up with an identical formula.

$50 – $50 = $0 gross profit

You normally wouldn’t hire someone for $50/hour and then bill them out at $50/hour as you’d just be breaking even. Instead, you’ll try to create some margin: maybe you’ll push your billing rate to $60/hour and seek to hire slightly lower cost labor at $40/hour. Maybe you hire an offshore contractor, or maybe someone earlier in their career than you, and fill the gap in skillset with extra oversight of their work. In this way, you’ll have created a bit of gross margin:

$60 – $40 = $20 gross profit ($20/$60 = 33% gross margin)

This is the fundamental challenge faced by all service-based businesses who bill by the hour. It’s very difficult to deliver quality work while squeaking out some margin when you’re charging a higher hourly rate but have less-skilled labor delivering your service!

Are you actually losing money?

However, it’s critical to understand this math, because the story doesn’t end with gross profit. Remember, all your other expenses still have to be paid before you see the true operating profit of your business. If you’re a solopreneur working out of your home you may not have office rent but you’ll still have expenses like marketing, website hosting and maintenance, software, etc.

So let’s think back to the solopreneur who’s billing themselves out at market rate because they were thinking their time didn’t have any cost. The operating profit (EBITDA) of their business is actually: ($50 * hours billed) – ($50 * hours worked) – all expenses = operating profit. Ouch. In reality, this is a business with a zero gross margin and an operating loss that equals their expenses!

In this case, the solopreneur set out to be a business owner… but ended up working a demanding job. Now they’re offering their service for less money than they’d be able to make at a job, with far more responsibility and stress. They’re not functioning as an owner; they’re functioning as a worker who also has to do billing, marketing, sales, and customer service for free when they’re not working billable hours.

If you’ve heard the saying, “you’re not working on your business, you’re working in your business,” this is the exact scenario it’s describing. Many solopreneurs fall into this trap.

Why is this such a big deal for solopreneurs?

If you’re thinking, “Ok, sure. I get it. And I do still work full-time. But I make decent money and work for myself. I’m ok with this, anyway,” let me point out a few other factors to consider.

First, if you’re a solopreneur who does everything, what happens when you get sick? You can’t work… and you lose money. What if you want to go on vacation? You can’t. When you’re a solopreneur you don’t get paid vacation! Sure, you have all the unpaid vacation you want, but forgoing that much income is difficult. When you’re the sole service provider and are reliant on a steady income, you’re basically chained to your desk for as long as you run your business. It’s a difficult lifestyle to have to evaluate every activity like taking time off, spending time with your family, or even exercising regularly vs. the income you lose by spending that time.

Next, scalability is impossible for service-based solopreneurs. There’s only one of you, so the revenue you can generate is capped by the number of hours you can work. If you’re making a great living, that’s fantastic, and you may not care. Regardless, though, remember that you won’t ever be able to give yourself a raise without raising your prices.

Finally, service-based solopreneurs will struggle to sell their businesses. If you retire, you’ll likely have to close your business, not sell it. If you have any hope of selling it you’d have to find someone with your exact skill set to buy it; because it’s worthless to anyone who can’t provide your service. It’s possible you could sell it to another service-provider in your space who wants to acquire your book of business. But realize this: the profitability of a business is generally what determines its value… and as we discussed, your business might not be profitable. This issue will curtail its value considerably.

So how do you fix this issue?

First, unless it’s mandatory in your industry to charge by the hour, the first thing you can do is move to a value-based pricing model. Your customer isn’t interested in buying your hours; they’re interested in buying the result of those hours. Rather than quoting your service in hours, consider quoting by the project, milestone, or deliverable. This will change the paradigm a bit.

Your sales process will change into a discussion about the result your client is looking for. Then you can ascribe value to that result and price based on the value your customer perceives. You may be able to push up your price based on selling value alone if you do it well.

This strategy has the added benefit of allowing you to make two other adjustments behind the scenes:

Hire lower-cost labor for lower-cost work

When you were doing everything yourself, you were inevitably doing some low-value work. Things like formatting, editing, email, scheduling, research, etc. can normally be done by someone with a far lower hourly rate than yours. If your market-rate is $50/hour and you can hire a $20/hour assistant to do a chunk of your project you will have just created more gross margin. You’ll also have freed up your time to do things more important: like build more business working on sales and marketing.

Improve efficiencies

Sadly, there’s a perverse incentive in hourly work to work a bit more slowly because it increases the size of your bill. This isn’t good for either you or your client. In contrast, if you sell a service project for a fixed price, you have all the incentive in the world to improve your efficiency and work as few hours as possible. Every hour you save increases your profitability and has the added benefit of delivering the work to your customer sooner!

One of your main goals should be to free up your time to get back to working on your business. You’ll be able to spend that time strategically rather than doing client work. You could work on sales and marketing yourself, or spend the time hiring a vendor to do that work for you. If you’re not working on building your business, no one is! If you’re completely jammed up, it might even make sense at the beginning to hire a contractor to take on some of your service work even if it’s at breakeven for you. Your time is your most valuable resource, so buying some of it back may open the door for much larger success.

Conclusion

If the gross margin in your solopreneurship wasn’t something you had thought through before, hopefully, this article gave you a new perspective. Once you understand the true gross margin of your business you can work to improve it! If you haven’t thought about building a team before, think about it now. Within a few years, you could have a business that earns far more money, runs even when you’re on vacation, and will be an asset even after you retire.